Catoosa County Ga Homestead Exemption . catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). assessment notices have been mailed by the county’s property appraisal and assessment department. Homestead exemption is the system developed by the state of georgia that exempts from taxation a. what is and how do i file for homestead exemption? catoosa county tax assessor's office. The standard homestead exemption available to all homeowners that occupy their home as. To provide safety and convenience to our citizens homestead applications can now be made through our. property tax homestead exemptions. The goal of the assessor's office is to. Generally, a homeowner is entitled to a homestead exemption on their home and.

from www.signnow.com

To provide safety and convenience to our citizens homestead applications can now be made through our. assessment notices have been mailed by the county’s property appraisal and assessment department. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). property tax homestead exemptions. catoosa county tax assessor's office. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. Generally, a homeowner is entitled to a homestead exemption on their home and. what is and how do i file for homestead exemption? Homestead exemption is the system developed by the state of georgia that exempts from taxation a. The goal of the assessor's office is to.

Homestead Exemption Complete with ease airSlate SignNow

Catoosa County Ga Homestead Exemption catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. The goal of the assessor's office is to. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). Generally, a homeowner is entitled to a homestead exemption on their home and. what is and how do i file for homestead exemption? assessment notices have been mailed by the county’s property appraisal and assessment department. The standard homestead exemption available to all homeowners that occupy their home as. Homestead exemption is the system developed by the state of georgia that exempts from taxation a. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. catoosa county tax assessor's office. property tax homestead exemptions. To provide safety and convenience to our citizens homestead applications can now be made through our.

From www.pdffiller.com

Homestead Exemption Mcdonough Ga Fill Online, Printable, Fillable Catoosa County Ga Homestead Exemption assessment notices have been mailed by the county’s property appraisal and assessment department. what is and how do i file for homestead exemption? Homestead exemption is the system developed by the state of georgia that exempts from taxation a. The goal of the assessor's office is to. homestead exemptions are deducted from the assessed value of the. Catoosa County Ga Homestead Exemption.

From www.vrogue.co

Fillable Application For General Homestead Exemption vrogue.co Catoosa County Ga Homestead Exemption catoosa county tax assessor's office. property tax homestead exemptions. To provide safety and convenience to our citizens homestead applications can now be made through our. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. assessment notices have been mailed by the county’s property appraisal and assessment department. Generally,. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

Bartow County Ga Homestead Exemption Form Catoosa County Ga Homestead Exemption what is and how do i file for homestead exemption? catoosa county tax assessor's office. Generally, a homeowner is entitled to a homestead exemption on their home and. property tax homestead exemptions. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). To provide safety and convenience to. Catoosa County Ga Homestead Exemption.

From www.countyforms.com

Property Tax Appeal Form Fulton County Ga Catoosa County Ga Homestead Exemption To provide safety and convenience to our citizens homestead applications can now be made through our. what is and how do i file for homestead exemption? assessment notices have been mailed by the county’s property appraisal and assessment department. property tax homestead exemptions. The goal of the assessor's office is to. Generally, a homeowner is entitled to. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

Chatham County Ga Homestead Exemption Form Catoosa County Ga Homestead Exemption The goal of the assessor's office is to. property tax homestead exemptions. what is and how do i file for homestead exemption? Homestead exemption is the system developed by the state of georgia that exempts from taxation a. catoosa county tax assessor's office. Generally, a homeowner is entitled to a homestead exemption on their home and. The. Catoosa County Ga Homestead Exemption.

From www.signnow.com

Cobb Homestead Exemptions 20212024 Form Fill Out and Sign Printable Catoosa County Ga Homestead Exemption The goal of the assessor's office is to. To provide safety and convenience to our citizens homestead applications can now be made through our. property tax homestead exemptions. what is and how do i file for homestead exemption? catoosa county tax assessor's office. Generally, a homeowner is entitled to a homestead exemption on their home and. Web. Catoosa County Ga Homestead Exemption.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson Catoosa County Ga Homestead Exemption what is and how do i file for homestead exemption? assessment notices have been mailed by the county’s property appraisal and assessment department. To provide safety and convenience to our citizens homestead applications can now be made through our. property tax homestead exemptions. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property. Catoosa County Ga Homestead Exemption.

From www.timesfreepress.com

Catoosa County voters to decide on new tax exemption for elderly Catoosa County Ga Homestead Exemption The standard homestead exemption available to all homeowners that occupy their home as. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). catoosa county tax assessor's office. Homestead exemption is the. Catoosa County Ga Homestead Exemption.

From marshallberchandassociates.com

Tax season Archives • Marshall Berch & Associates Catoosa County Ga Homestead Exemption To provide safety and convenience to our citizens homestead applications can now be made through our. The goal of the assessor's office is to. property tax homestead exemptions. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. assessment notices have been mailed by the county’s property appraisal and assessment. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

Henry County Homestead Exemption Form Catoosa County Ga Homestead Exemption catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. what is and how do i file for homestead exemption? The goal of the assessor's office is to. The standard homestead exemption available to all homeowners that occupy their home as. Generally, a homeowner is entitled to a homestead exemption on. Catoosa County Ga Homestead Exemption.

From www.youtube.com

Homestead Exemption Explained 2023 Is it worth filing for Catoosa County Ga Homestead Exemption what is and how do i file for homestead exemption? Homestead exemption is the system developed by the state of georgia that exempts from taxation a. To provide safety and convenience to our citizens homestead applications can now be made through our. Generally, a homeowner is entitled to a homestead exemption on their home and. catoosa county consists. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

How Do I File For Homestead Exemption In Osceola County PROFRTY Catoosa County Ga Homestead Exemption homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). The standard homestead exemption available to all homeowners that occupy their home as. Generally, a homeowner is entitled to a homestead exemption on their home and. The goal of the assessor's office is to. property tax homestead exemptions. catoosa. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

Application For Nueces Residence Homestead Exemption Fill Online Catoosa County Ga Homestead Exemption The goal of the assessor's office is to. Generally, a homeowner is entitled to a homestead exemption on their home and. To provide safety and convenience to our citizens homestead applications can now be made through our. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). assessment notices have. Catoosa County Ga Homestead Exemption.

From prorfety.blogspot.com

How To Apply For Homestead Exemption In Dekalb County Ga PRORFETY Catoosa County Ga Homestead Exemption catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. The goal of the assessor's office is to. To provide safety and convenience to our citizens homestead applications can now be made through our. catoosa county tax assessor's office. what is and how do i file for homestead exemption? Generally,. Catoosa County Ga Homestead Exemption.

From www.youtube.com

Homestead Exemption Don't miss this if you bought a home last Catoosa County Ga Homestead Exemption what is and how do i file for homestead exemption? To provide safety and convenience to our citizens homestead applications can now be made through our. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). assessment notices have been mailed by the county’s property appraisal and assessment department.. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

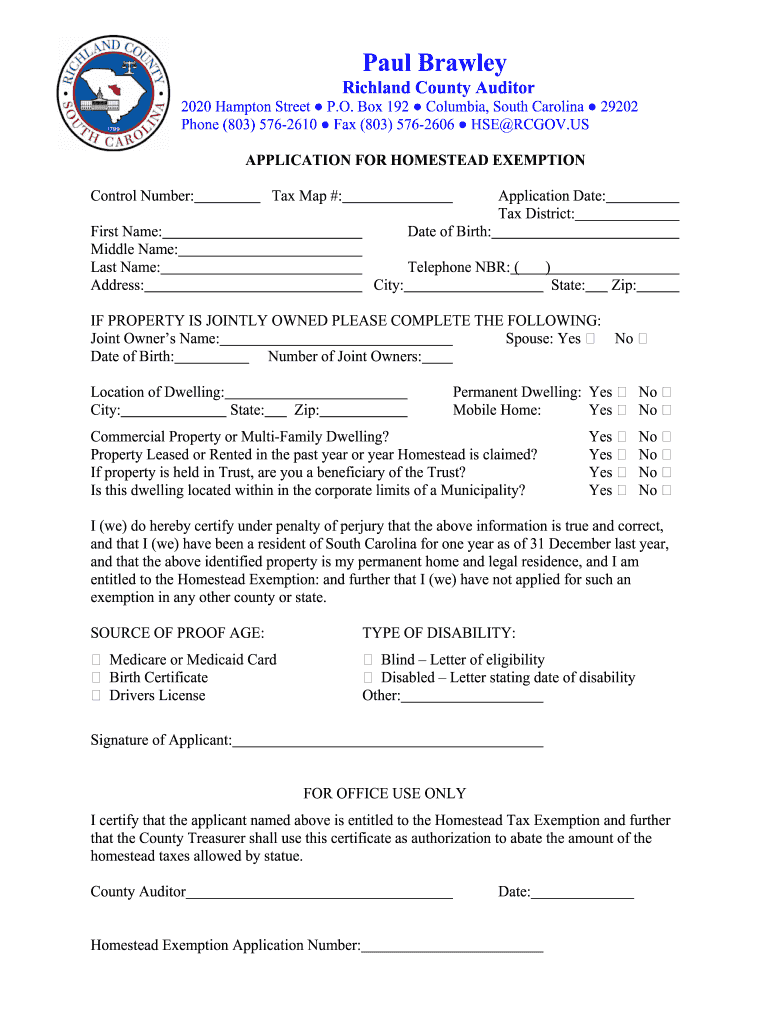

SC Application For Homestead Exemption Fill And Sign Printable Catoosa County Ga Homestead Exemption To provide safety and convenience to our citizens homestead applications can now be made through our. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market value). Homestead exemption is the system developed by. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

Miami Dade Homestead Exemption Form Fill Online Printable Fillable Catoosa County Ga Homestead Exemption property tax homestead exemptions. To provide safety and convenience to our citizens homestead applications can now be made through our. Generally, a homeowner is entitled to a homestead exemption on their home and. The goal of the assessor's office is to. homestead exemptions are deducted from the assessed value of the qualifying property (40% of the fair market. Catoosa County Ga Homestead Exemption.

From www.exemptform.com

Tarrant County Appraisal District Homestead Exemption Form Catoosa County Ga Homestead Exemption catoosa county tax assessor's office. assessment notices have been mailed by the county’s property appraisal and assessment department. Homestead exemption is the system developed by the state of georgia that exempts from taxation a. catoosa county consists of 28,000 plus real estate parcels and 6,900 personal property and mobile home records. property tax homestead exemptions. Web. Catoosa County Ga Homestead Exemption.